Navigating the process of obtaining a Tax Identification Number (TIN) can feel like a complex journey, but it’s a vital step for anyone in the Philippines engaging in financial or government-related transactions. Whether you are an employee, a business owner, or a freelancer, securing your TIN from the Bureau of Internal Revenue (BIR) is necessary to ensure compliance with tax regulations. This guide aims to walk you through the essential steps of the TIN application process, helping you understand the requirements and making the experience as smooth as possible.

In this TIN Application Guide, you’ll learn the details of how to apply for your number depending on your employment status, whether you’re self-employed, an employee, or a corporate taxpayer. Knowing how to correctly navigate the system can save you both time and hassle, ensuring that your transactions with the BIR are efficient. From required documents to important deadlines, this guide provides all the information you need for a successful TIN application.

A Tax Identification Number (TIN) is one of the most important identifiers you will have in your lifetime. Whether you are filling out forms or submitting documents, your TIN will be required on numerous occasions. In fact, it is so significant that memorizing it can save you time and hassle. For those who have yet to be issued a TIN, here is a comprehensive guide to acquiring your TIN in the Philippines.

What is a TIN?

A Tax Identification Number (TIN) is a unique identifier issued by the Bureau of Internal Revenue (BIR) to individuals and businesses for tax-related purposes. This permanent number helps in tracking tax payments, obligations, and return filings, ensuring compliance with tax laws. Similar to other government-issued IDs like the Social Security System (SSS), PhilHealth, or Pag-IBIG numbers, the TIN is a critical requirement for various official transactions, such as securing permits, voter registration, opening bank accounts, and registering vehicles with the Land Transportation Office (LTO).

In addition to its use for tax purposes, having a TIN is essential to obtain a TIN ID card, which is widely accepted as a valid identification document in the Philippines. This makes it an indispensable tool for individuals and organizations alike when dealing with both government institutions and financial entities. The TIN ID card also streamlines many processes, providing a unified identification method for a range of transactions.

Who Needs to Get a TIN?

Goldpriceph.com – Both Filipino citizens and foreign nationals earning income in the Philippines are legally required to register with the BIR and obtain a TIN. However, non-taxpayers may also need a TIN under Executive Order (EO) 98, which mandates the issuance of a TIN for individuals transacting with government offices or financial institutions. The following individuals and entities must apply for a TIN if they have not yet been issued one:

- Self-employed individuals (e.g., freelancers, professionals, entrepreneurs, online sellers)

- Mixed-income earners (those employed but also earning through other means)

- Estates and trusts

- Employees working in the Philippines, whether local or foreign

- Corporate taxpayers (corporations, partnerships, NGOs, and other registered organizations)

- Persons registering under EO 98 to transact with government agencies, including unemployed Filipinos and OFWs

- One-time taxpayers (those paying capital gains tax, estate tax, or tax on winnings for the first time)

How to Apply for a TIN in the Philippines

The process of applying for a Tax Identification Number (TIN) differs based on the applicant’s employment or business status. Each category requires specific documentation and steps, which must be followed to successfully obtain the TIN. Whether you are an employee, self-employed individual, or part of an organization, it’s crucial to understand the appropriate procedure for your category to ensure a smooth application process.

For employees, the process typically involves submitting BIR to the employer, who then files the application with the Bureau of Internal Revenue (BIR). On the other hand, self-employed individuals and freelancers must complete BIR and submit it directly to the BIR along with supporting documents like a valid ID and proof of business registration, if applicable. This category also includes mixed-income earners, who need to declare both their employment and self-employment income for proper tax tracking.

Corporations, partnerships, and other organizations follow a different procedure by submitting BIR. These entities must also provide copies of their SEC Certificate of Incorporation or equivalent documents for partnerships, along with other required paperwork. Understanding the specific TIN application process for your category is essential to ensure timely compliance with tax regulations.

TIN Application for Self-Employed and Mixed-Income Individuals

Requirements:

- Accomplished BIR

- Valid government-issued ID

- BIR Printed Receipts or a sample of Principal Receipts

- Additional documents (if applicable), such as a Special Power of Attorney, DTI certificate for business names, or trust agreements

Steps to Apply:

- Visit the Revenue District Office (RDO) with jurisdiction over your residence or business location.

- Submit the required documents at the New Business Registrant Counter.

- Pay the annual registration fee of ₱500, along with a ₱30 documentary stamp tax.

- Attend the scheduled briefing for new business registrants.

- Receive your Certificate of Registration, Notice to Issue Receipts/Invoices, and other relevant documents containing your TIN.

Deadline: Self-employed and mixed-income individuals must register for a TIN before starting their business or within 30 days of receiving a business permit.

TIN Application for Employees

Requirements:

- Accomplished BIR

- For Filipino employees: valid ID, marriage certificate (if applicable)

- For foreign employees: passport and work permit

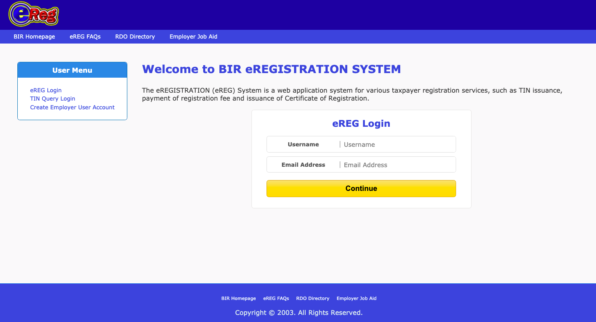

Steps to Apply: Submit the completed BIR to your employer, who will file it with the appropriate RDO. Alternatively, your employer may register you online using the BIR eRegistration (eReg) system, if available.

Deadline: New employees must secure a TIN within 10 days of starting their employment.

TIN Application for Corporations and Partnerships

Requirements:

- Accomplished BIR

- Photocopies of SEC Certificate of Incorporation, Articles of Incorporation, or Partnership documents

- Other documents, such as board resolutions or proof of registration, if applicable

Steps to Apply:

- Visit the RDO with jurisdiction over your office location.

- Submit the required documents at the New Business Registrant Counter.

- Pay the ₱500 registration fee and ₱30 documentary stamp tax.

- Attend the briefing for new business registrants.

- Obtain your Certificate of Registration and other related documents.

Deadline: Corporations and partnerships must apply for a TIN before commencing business operations or within 30 days of receiving their business permit or SEC registration.

TIN Application for OFWs and Unemployed Filipinos

Requirements:

- Accomplished BIR

- Valid government-issued ID (e.g., passport, birth certificate)

- For OFWs: employment contract

Steps to Apply: Go to the RDO in your area and inform the BIR officer that you are applying for a TIN under EO 98. Submit your documents and wait for the processing of your TIN.

Deadline: OFWs and unemployed individuals should apply for a TIN before any government transactions.

Verifying Your TIN Online

If you have misplaced your TIN, you can now verify it online by visiting the BIR website. Use the “Chat with Revie” feature to confirm your TIN details.

Frequently Asked Questions (FAQs)

How many digits does a TIN have?

A TIN consists of 12 digits, with the last three reserved for corporate taxpayers.

Can I apply for a TIN online?

Currently, online registration is only available to corporations through the eReg system.

Do I need to get a new TIN for a new job?

No, your TIN is permanent. You only need to update your information if your residence or employment changes.

What if I have multiple TINs?

Having more than one TIN is illegal. You should request cancellation of duplicate TINs at your RDO.

Do I need to re-register my business annually?

No, business registration is a one-time process. However, you must pay an annual registration fee of ₱500 by January 31.

How do I contact the BIR for TIN-related concerns?

You can reach the BIR by calling 8538-3200 or emailing [email protected].

Conclusion

Securing a Tax Identification Number (TIN) is an important step for anyone looking to earn an income or engage with government entities in the Philippines. The process is typically straightforward, but it is crucial to ensure that you do not already have a previously assigned TIN. Having multiple TINs can lead to legal complications that may be avoided by confirming your tax status before applying. Having a valid TIN simplifies your financial and legal transactions, ensuring smooth interactions with both private and public institutions.

It is essential to confirm that your information is up to date, as this can help you avoid unnecessary delays or issues when dealing with the authorities. By taking the time to verify your tax identification status, you protect yourself from future complications. A simple check now can prevent what might become a time-consuming and stressful situation later, ensuring that you remain compliant with tax regulations while efficiently managing your responsibilities.