Unlocking the mysteries of essential documents can often feel like embarking on a scavenger hunt, but understanding the cedula is key to simplifying various official tasks. How to Get Cedula is more than just a question-it’s an entry point into grasping how this important certificate functions in everyday life. From confirming your payment of community taxes to serving as a valid ID, the cedula holds significant value in navigating both personal and business transactions within your local municipality.

Navigating the process to acquire your cedula can be straightforward when you know what to expect. This guide will delve into what the cedula is used for and offer a step-by-step approach on how to obtain yours efficiently. With the right information at your fingertips, you’ll be equipped to manage community interactions and formalities with greater ease and confidence.

Do you need additional identification documents for your personal records? If so, a community tax certificate, commonly referred to as a “cedula,” might be just what you’re looking for. It can serve as a valid form of identification and supports various administrative processes.

Many Filipinos are unaware that a cedula can be used for identification purposes. Furthermore, the fees collected from cedula issuance contribute to the local government funds of your city, municipality, or barangay. Although there have been attempts to abolish the cedula, it remains a valuable document. This guide will explain its significance and the process to obtain one.

What is a Cedula?

Goldpriceph.com – A cedula is an official certificate given to residents in the Philippines after they settle their community tax. This document serves as a fundamental requirement for a variety of transactions involving government entities. Beyond its role in official dealings, the cedula functions as a legitimate form of identification for both individuals and businesses within the local municipality where it is issued.

The cedula is more than just a receipt for tax payment; it is a versatile tool that facilitates numerous interactions with government offices and other official bodies. By having this certificate, residents can smoothly engage in activities that require proof of identification or compliance with local regulations. Its utility extends across various sectors, making it an important asset for anyone navigating municipal affairs.

Obtaining a cedula is a relatively straightforward process, designed to be accessible and efficient. Once acquired, it not only fulfills the obligation of community tax but also enhances one’s ability to conduct business and participate in local governance. This document ensures that individuals and businesses are recognized within their municipality, streamlining interactions and reinforcing their standing within the community.

Features of a Cedula

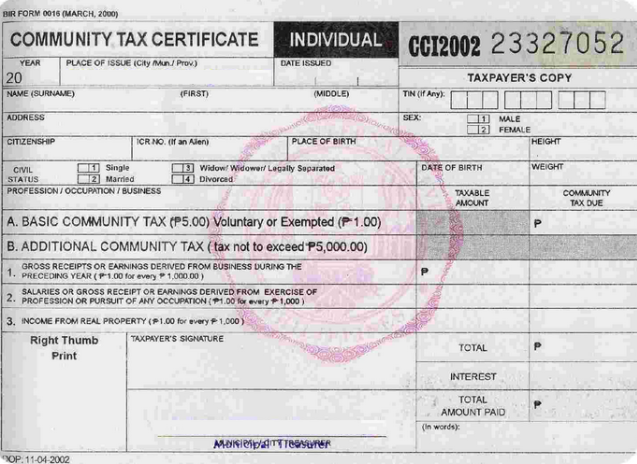

For individuals, a cedula contains important details such as:

- Full name (surname, first name, middle name)

- Address

- Sex

- Citizenship

- Date and place of birth

- Height and weight

- Civil status

- Profession, occupation, or business

- Tax Identification Number (TIN)

- Community tax amount due

- Signature and right thumbprint

- Signature of the issuing officer

Cedula Validity

The cedula is valid for one year from the date of issue. For example, if you obtain it in July, it will remain valid only until the same date in the following year.

Why is a Cedula Important?

The use of the cedula dates back to the Spanish colonial period when residents aged 18 and above were required to carry it as proof of identification and tax payment. According to the Local Government Code, cities and municipalities have the authority to levy a community tax on both individuals and businesses. The tax is due annually, starting on January 1 and must be paid by the end of February.

There are also exemptions for certain individuals, including:

- Diplomatic and consular officials

- Visitors staying in the Philippines for less than three months

If exempt from the community tax, a person or corporation can still obtain a cedula for a nominal fee.

When Do You Need a Cedula?

A cedula is required for many official processes, such as:

- Registering or renewing a business

- Applying for a job

- Purchasing property

- Obtaining a marriage license

- Filing income tax returns (ITR)

- Notarizing documents

- Applying for licenses or certificates from government offices

- Receiving government payments or salaries

- Submitting proof of residency, property ownership, or professional dues

Who Can Apply for a Cedula?

To be eligible for a cedula, you must be:

- A Philippine resident aged 18 or above

- An employee who has worked for at least 30 consecutive days

- A business owner operating within the city or municipality

- A property owner with real estate valued at ₱1,000 or more

- Required by law to file an income tax return

Can Students Apply for a Cedula?

Students who are 18 years old or older are eligible to apply for a cedula. To complete the application process, they must present either a school ID or their latest school enrollment records. Additionally, they will need to fill out the appropriate application form and settle any applicable fees.

The process is designed to be straightforward, ensuring that students can easily obtain their cedula as long as they meet the age requirement. By providing the necessary documentation and payment, students can successfully secure this important certificate, facilitating their engagement in various administrative and official activities.

Can Someone Apply for a Cedula on Your Behalf?

No, you must apply for the cedula yourself, as the process requires your signature and thumbprint. However, if your municipality offers an online application system, someone may assist you in setting up your account or completing the form.

Cedula Requirements

Although requirements may differ across municipalities, common documents include:

- Completed Community Tax Declaration Form

- Valid government-issued ID

- Proof of income (e.g., pay slip)

For business owners, an approved business tax declaration evaluated by the City Treasurer’s office may also be needed.

Where Can You Obtain a Cedula?

Cedulas can be obtained from your local barangay, municipal hall, or city hall. Business owners may also apply for one in the municipality where their business is located.

Steps to Obtain a Cedula

Here’s how to acquire a cedula:

- Visit your barangay, municipal, or city hall and locate the designated counter for cedula applications.

- Fill out the Community Tax Declaration Form with the necessary details.

- Present your ID and any required documents, such as proof of income for employees or business assessments for entrepreneurs.

- Pay the applicable fees, sign the form, and provide your thumbprint.

- Wait for your cedula to be issued.

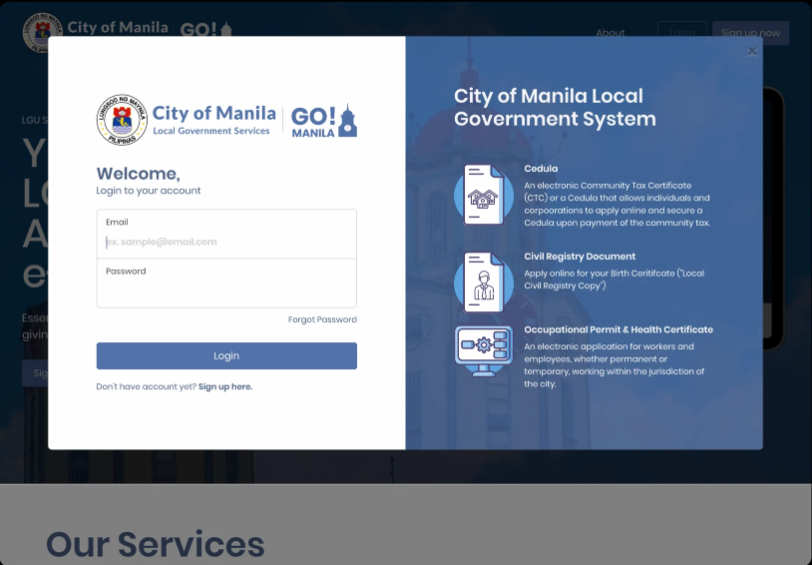

Online Cedula Application

Some cities, like Manila and San Fernando in La Union, allow residents to apply for a cedula online. You can complete the application form, print it, and submit it at the city hall when paying the fees. Manila residents can also use the Go! Manila app to get a cedula without visiting city hall.

Cedula Fees

The cost of a cedula varies depending on your municipality, occupation, income, and business type. Here’s a breakdown of how the fees are calculated:

For individuals:

- Basic community tax (starting at ₱5)

- An additional ₱1 for every ₱1,000 of income from the previous year

- An additional ₱1 for every ₱1,000 of a property’s assessed value

For corporations:

- Basic community tax (starting at ₱5)

- An additional ₱2 for every ₱5,000 of gross earnings from the previous year

- An additional ₱2 for every ₱5,000 of a property’s assessed value

Conclusion

A cedula plays a crucial role in numerous transactions, often becoming essential when you least expect it. Its significance extends beyond just identification; it also confirms that you have fulfilled your community tax obligations. This not only streamlines your interactions with government agencies but also ensures that other formalities proceed without unnecessary delays.

Fortunately, acquiring a cedula is both simple and cost-effective. Its dual purpose as both an identification document and proof of tax payment makes it a valuable asset in navigating various official processes. With its importance firmly established, having a cedula can greatly ease your dealings with both public and private institutions.