Getting a Tax Identification Number (TIN) ID is a crucial step for anyone who needs to prove their taxpayer status in the Philippines. This ID is often required for various transactions, not only with the Bureau of Internal Revenue (BIR) but also with other government offices and financial institutions. Understanding the steps involved, knowing the requirements, and preparing all necessary documents in advance will make the process of obtaining a TIN ID much smoother and more efficient.

Before visiting your designated Revenue District Office (RDO), it’s important to be fully informed about how to get TIN ID. Whether you are a new employee, a self-employed individual, or simply updating your details, each type of applicant has specific procedures to follow. By familiarizing yourself with the steps, you can avoid unnecessary delays and ensure a hassle-free experience when securing your TIN ID.

As a taxpayer, you play a vital role in the country’s development by contributing a portion of your income. Obtaining a Tax Identification Number (TIN) ID from your local Bureau of Internal Revenue (BIR) office serves as proof of your responsibility as a citizen. The TIN ID not only verifies your taxpayer status but also functions as a secondary identification card for various transactions with government agencies and financial institutions. Whether you’re a new employee or a seasoned worker, knowing how to get this card is essential, especially since it can be acquired within a day.

This guide will walk you through the process of obtaining a TIN ID, including the requirements, fees, and other relevant details. From understanding what a TIN ID is to learning how to apply for both physical and digital versions, you’ll find all the information you need to simplify the process.

What is a TIN ID?

The Taxpayer Identification Number Identification Card, often referred to as a TIN card or TIN ID, is a card that contains your unique taxpayer identification number. Issued exclusively by the Bureau of Internal Revenue (BIR), this card features personal information like your full name, TIN, birthdate, address, and a photograph. It’s a crucial document for tax-related purposes and is recognized by certain government and financial entities. The TIN ID is available in two designs-a yellow-orange version and a green one-but both remain valid indefinitely as the card does not expire.

Since the card is made from a relatively fragile material, most people choose to have it laminated to protect it from damage over time. Though primarily used for tax purposes, the TIN card can also be accepted as a secondary ID for other official purposes, but some organizations may not recognize it as a primary ID.

What is the TIN ID Used For?

Goldpriceph.com – Various government agencies and financial institutions accept the TIN card, although it is often treated as a secondary form of identification. While agencies like the National Bureau of Investigation (NBI) and the Philippine National Police (PNP) accept it for certain clearance applications, others, such as the Social Security System (SSS) and the Philippine Postal Corporation, do not consider it a primary ID. Banks also vary in their policies; for instance, some accept it as a secondary ID, but larger institutions like BPI and Metrobank require another form of identification.

Thus, it’s wise to bring along a more widely accepted government-issued ID like a driver’s license or passport, while using your TIN card as a supplemental form of ID during official transactions.

TIN ID Requirements

To apply for a TIN ID, especially if you’re registering for the first time as a taxpayer, you’ll need to gather the following documents:

- Completed BIR registration

- One valid government-issued ID

- Birth certificate issued by the Philippine Statistics Authority (PSA)

- Community Tax Certificate (cedula)

- 1×1 ID picture (if required)

- Marriage certificate (if applicable)

It’s important to note that each taxpayer is assigned a specific Revenue District Office (RDO), which manages your tax records based on your residence or place of employment. You’ll need to apply for your TIN card at your designated RDO. To determine your RDO, you can contact the BIR’s Customer Assistance Division.

Steps for Getting a TIN ID Card

For New Employees:

Most employers assist new employees by handling their TIN ID applications. In this case, you’ll simply need to fill out BIR and provide the necessary documents to your human resources department, who will process the application for you. If you’re required to handle the process yourself, you’ll need to submit the documents to the RDO where your employer is registered, and you should receive your TIN card within the same day.

For Existing Employees and Individuals with a TIN:

According to BIR’s Revenue Memorandum Order, a personal appearance is mandatory for individuals applying for a TIN card, although in certain valid cases, you can send an authorized representative with a special power of attorney (SPA) to claim the card on your behalf. This is also applicable for self-employed individuals who already have an existing TIN and wish to obtain a physical TIN card.

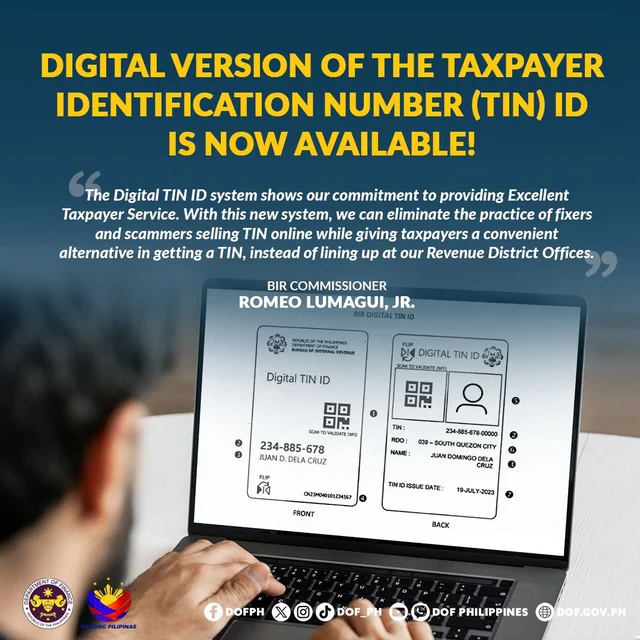

How to Get a Digital TIN ID

In response to the growing demand for digital services, the BIR now offers a digital version of the TIN card, which you can apply for via the Online Registration and Update System (ORUS). This service is available to individuals who already have a TIN, and there’s no need to visit the RDO in person. To apply, you must first update your email address with the RDO by submitting Form S (Registration Update Sheet). Once your account is set up, your digital TIN ID will be generated, and it can be verified through a QR code.

How to Get a TIN ID for Students and Unemployed Individuals

Filipino citizens above the age of 18, including students and unemployed individuals, can apply for a TIN ID under Executive Order No. 98. The application process involves submitting BIR along with a valid government-issued document, such as a birth certificate or passport, to the RDO that covers your area of residence.

Replacing a Lost or Damaged TIN ID

In case your TIN ID is lost or damaged, you can apply for a replacement at your RDO. To do this, you’ll need to fill out BIR (Registration Information Update) and Form 0605 (Payment Form). For a lost card, you’ll also need a notarized affidavit of loss. A small fee applies for the replacement, which can be paid at the RDO’s authorized bank. Once processed, you’ll receive a new card.

Important Reminders When Applying for a TIN ID

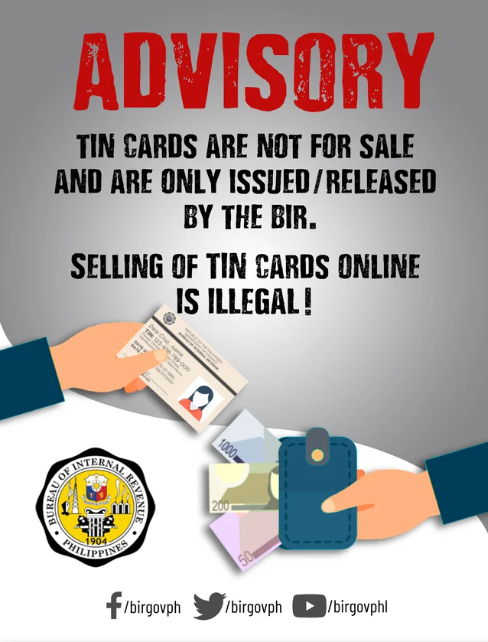

Avoid dealing with unauthorized parties or “fixers” who may offer to expedite the TIN ID application process for a fee. These services are illegal, and the BIR warns against engaging with such individuals. Always apply directly through the proper channels, whether for a physical or digital TIN card, to avoid scams.

Additionally, remember that each taxpayer is assigned only one TIN for life. Having multiple TINs is illegal and punishable by law, so be sure to keep your records updated but avoid applying for more than one TIN.

FAQs About TIN IDs

Is a TIN card a valid ID?

Yes, but it is typically considered a secondary ID. When applying for documents like passports, a primary ID such as a driver’s license or postal ID is required, with the TIN card serving as supplemental identification.

Can I replace my TIN card online?

No, you must visit your designated RDO for any replacements.

How much does it cost to get a TIN ID?

The TIN ID is free of charge. However, fees apply for business TINs or replacing a lost or damaged card.

How long does it take to replace a TIN card?

Replacing a TIN card typically takes one to two hours, provided you complete the required forms beforehand.

Can I change my name on my TIN card?

Yes, but this process involves updating your Certificate of Registration and business-related documents.

Is the digital TIN ID free?

Yes, and it offers a convenient alternative to the physical card.

Can I get a digital TIN ID if I don’t have a TIN?

No, only individuals with an existing TIN can apply for the digital version.

By following the steps outlined in this guide, you can efficiently obtain a TIN ID, whether physical or digital, and ensure you comply with tax-related requirements.

Conclusion

Obtaining a TIN ID is an essential process for anyone who wishes to engage in tax-related transactions in the Philippines. Whether you’re a first-time taxpayer, a student, or an employed individual, preparing the required documents and knowing which steps to follow can make the application process straightforward. Visiting the correct Revenue District Office (RDO) and adhering to their guidelines will help you avoid unnecessary delays and ensure that you receive your TIN ID efficiently. With the availability of both physical and digital TIN IDs, applicants now have more flexible options for securing this important document.

It’s also important to remember that your TIN ID serves as more than just a tax identification tool; it is recognized by several institutions for various transactions. Being aware of how to apply, update, or replace your TIN ID, as well as the penalties for having multiple TINs, will help you navigate the system smoothly. With proper preparation, you can ensure that your TIN ID is processed without any issues, allowing you to fulfill your obligations as a responsible taxpayer.